Prince Fastener:The price of Nickel has reached a record high, and the cost of stainless steel fasteners is rising?

Under the influence of tight supply and squeezed positions, the price of Nickel has been “off the leash”! On March 8, the LME nickel futures contract price rose from $29,770/ton opened on the 7th to a maximum of $101,365/ton. It has increased more than 230% in the past two days. Affected by this, the domestic commodity futures market closed on the 8th, and the main Shanghai nickel contract continued to seal the daily limit, closing at 228,810 CNY/ ton.

Subsequently, the London Metal Exchange (LME) suspended nickel trading and announced that it would postpone the delivery of all spot nickel contracts initially scheduled for delivery on March 9; cancel all over-the-counter transactions at or after 00:00 a.m. UK time on March 8. and nickel trades performed by the LME select screen trading system.

Several future researchers told reporters that the surge in nickel prices has fundamental bullish factors, but the increase has far exceeded the bullish level. In the future, nickel prices face a significant risk of correction, and the timing of the sentence is difficult to grasp. So the first thing for investors is to control risks, reduce positions, and even wait and see with short posts.

The new LSE deferred delivery rules can alleviate the current problems faced by the Tsingshan Group. Although according to the complete response of Tsingshan Industrial Xiang Guangda to the first financial reporter, Tsingshan received many calls that day, Tsingshan is an excellent Chinese enterprise, and there are no problems with its positions and operations.

Tsingshan Holdings is in a crisis?

With the continuous rise of LME nickel, the short position of Tsingshan Holdings was squeezed and further fermented.

According to a research report by Haitong International, Tsingshan Holdings is a private enterprise specializing in stainless steel production. The company’s main business includes stainless steel and new energy industry chains. According to company disclosures, its nickel-equivalent production will reach 600,000 tons in 2021, 850,000 tons in 2022, and jump to 1.1 million tons in 2023. Upstream resources are the ferronickel business and the layout of laterite nickel mines in Indonesia.

In terms of production capacity, Tsingshan Holdings’ domestic ferronickel business is mainly deployed through Fujian Tsingtao Group. At present, Qingtuo Group has formed an annual production capacity of 1.8 million tons of nickel alloys. Foreign trade is realized through Indonesia Qingshan Park (IMIP) and Weidabe Industrial Park (IWIP), with a total production capacity of more than 3.5 million tons per year.

In the past two days, it was rumored that Tsingshan Group held an empty order of 200,000 tons of nickel futures contracts, which foreign traders squeezed due to the lack of spot and were unable to deliver. Earlier, foreign media reported that Glencore held a 60% long position in LME nickel futures.

In the opinion of many industry insiders, one of the reasons for Tsingshan Holdings’ significant loss is that the nickel delivery products of LME require a nickel content of not less than 99.8%. In contrast, the nickel content of Tsingshan Holdings’ nickel products cannot reach the level which is challenging to achieve in the market. Delivery on the LME. LME’s deliverables are mainly nickel plates and nickel beans. Tsingshan’s main products, ferronickel (with a nickel content of about 10%) and high matte Nickel (with a nickel content of about 70%), cannot be used as delivery targets.

Why did Tsingshan Holdings open a large number of short orders on the LME when the spot in hand could not be delivered? Wang Yanqing, a metals analyst at CITIC Construction Investment Futures, told Yicai that Tsingshan Holdings controls 1/3~1/4 of the world’s nickel production. Therefore, for hedging purposes, it has a natural motivation to go short; However, Tsingshan Holdings’ nickel products cannot be sold in LME delivery, ferronickel is also priced through Lun nickel, and the price of its products is closely related to the cost of lun nickel.

“The situation in Ukraine is a fuse that detonated the risk incident of Tsingshan Holdings. Russian Nickel has a more important position in the supply of pure Nickel. In the context of the continued expansion of sanctions in Europe and the United States, the export of Russian Nickel was blocked, Tsingshan Holdings could not buy the corresponding Nickel goes to delivery, and the overall pure nickel inventory was low. Therefore, when the funds continue to raise the price of Nickel, Tsingshan Holdings can only make up the deposit.” Wang Yanqing said.

Suppose Tsingshan Holdings’ short position of 200,000 tons reported by the media is calculated. In that case, the current nickel price of London is 80,000 US dollars/ton, then Tsingshan Holdings will spend 16 billion US dollars. If it is a loss of 10 billion US dollars, can Tsingshan Holdings afford it?

In this regard, some brokerage analysts believe that Tsingshan Holdings’ revenue in 2021 will exceed 350 billion yuan. As a leading company with a global market share of more than 20% of stainless steel crude steel, tens of billions of profits have accumulated for decades. In 2009, it took root in Indonesia. So enjoy the dividend of laterite nickel ore-nickel-iron-stainless steel. Of course, a loss of tens of billions of dollars affects cash flow, but it is not expected to be fatal. However, some future people believe that tens of billions of dollars need liquidity to make up, and Tsingshan Holdings may be in trouble.

According to media reports, Tsingshan Holdings has held a short position in LME nickel for some time. A big question in the market is that after the official outbreak of the situation in Ukraine, why did Tsingshan Holdings not withdraw, and the position has always been there?

Many people in the futures industry believe that it is already a clear sign from the perspective of the international situation. Tsingshan Holdings may have thought that the follow-up price would fall or not predicted that the funds would rise sharply. However, the occurrence of the current risk events also shows that there may be specific problems in the risk control of Tsingshan Holdings. This incident also reminded domestic enterprises that they need to make good predictions and do a good job of risk control in extreme situations.

Nickel price outlook faces a greater risk of a correction.

In addition to the push of funds, from the perspective of fundamentals, what factors are driving the soaring nickel price, and what risks are faced by the market outlook?

“At present, such a high rise in LME nickel has completely deviated from the fundamentals, because Russia’s nickel production accounts for a small proportion of the world, and the main driving force for the rise comes from capital and sentiment, and the large number of long investors entering the market has formed a severe squeeze on the shorts. “Xia Yingying, the metals analyst at South China Futures, told Yicai.com.

Wang Yanqing believes that the situation in Ukraine is the trigger for the sharp rise in nickel prices since March, and Europe and the United States have launched multiple rounds of sanctions. Since the corresponding product of Lun nickel is pure Nickel, Russian Nickel has a higher position in the supply of pure Nickel. Still, the current stock of pure Nickel is low, and the space for supply relaxation is minimal. Since March, London nickel has risen by more than 100%, which is difficult to support by reducing supply.

The Shanghai-London spread for Nickel has continued to widen since the end of February. Wang Yanqing said that the reason for this situation is that China can obtain Russian nickel supply, and the domestic supply is expected to be more abundant than that of foreign countries.

“If Russian Nickel enters the country and settles at the price of RMB, and Russian Nickel cannot be exported to other countries again, then naturally there will be a price depression in domestic nickel prices, and there is no room for convergence of internal and external price differences. If Russian Nickel is still settled at LME prices, then the current import window cannot be opened.” He further analyzed that, in theory, the foreign gap can be filled by exporting pure domestic Nickel abroad, thereby reducing the price difference between domestic and foreign. Still, the Nickel that my country can export is very limited, making up for the drop in foreign supply. Over the years, my country has been a net importer of Nickel.

Xia Yingying believes that in the future, the nickel price difference at home and abroad will first return, and then the two will run simultaneously to a reasonable range. Therefore, the part that rose sharply on March 8 may be quickly withdrawn in the next few trading days, but the total price will fall back. The process may take several weeks.

Regarding the risk factors facing Nickel in the future, Wang Yanqing believes that there are three aspects: First, the situation in Ukraine may be eased. The second is the opening of the Russian nickel export channel. At present, Europe and the United States have not directly targeted Russian nickel sanctions. The main reason is that the fear of market spread has made all parties reluctant to trade with Russian Nickel to avoid potential risks. Second, suppose the Russian nickel export channel is opened up, including the smooth domestic import of Russian Nickel. In that case, the supply worries will no longer be concerned, suppressing the nickel price. Third, demand has weakened significantly. At present, some downstream companies have begun to suspend orders, waiting for costs to become apparent. If the downstream continues to stagnate and demand weakens sharply, it will also risk a correction to nickel prices.

“The current rise in nickel prices is difficult to explain from a fundamental perspective. Although the overall environment is still favorable for nickel prices, follow-up risks cannot be ignored.” Wang Yanqing said.

Xia Yingying also reminded the risk that in the face of extreme market conditions, the first thing for investors to do is to control risks, reduce positions as much as possible, or even wait and see with short posts. Because of extremely high volatility, the exchange will increase the margin, and the price of commodities can quickly rise and fall sharply, and customers will face the risk of liquidation. At the same time, the extreme market is neither a trending market nor a volatile market, and it is more challenging to operate, and it is easy to cause huge floating losses. Therefore, controlling risk is particularly important at this moment.

On March 8, the Shanghai Futures Exchange issued a risk warning saying, “The current international situation is complicated and volatile, and the price of Nickel in the overseas futures market has fluctuated violently. Our exchange will take further measures according to market conditions and regulations. Member units and investment Those who do a good job in risk prevention work, invest rationally, and jointly maintain the smooth operation of the market.”

Where does stainless steel decouple from nickel prices go?

1. Spot traders are reluctant to sell and adjust prices several times within a day

Judging from the current stainless steel fastener spot trading market, most of the 300 series hot-rolled hot-rolled products are out of stock, and most merchants do not report, and the cold-rolled price continues to move closer to futures. After the rapid price increase for several consecutive days, the downstream mostly took a cautious wait-and-see attitude, and the reluctance of merchants to sell became prominent. Many merchants required customers to purchase in full to cope with the risk of price increases.

Judging from the historical highs, in September 2021, due to the impact of production and power restrictions in China, the supply reduction in steel mills superimposed the resonance of bulk commodities, and the spot price ushered in a new high in recent years. At that time, the cost of 304 cold rollings was 22,000 Yuan/ton, and the current highest price (22,300 Yuan/ton) has broken through last year’s high, and there is still a small number of transactions the market at the current price.

2. London nickel rose by more than 90% in one day, and the decoupling of stainless steel and nickel prices intensified

At present, London’s Nickel is greatly strengthened due to the influence of the capital game and squeezed positions, and it may remain strong until the capital game is over. At present, the valuation of the Nickel and stainless steel industry chain is in order of London nickel, Shanghai nickel, ferronickel, stainless steel, from high to low. Stainless steel is in the relatively low valuation part of the industrial chain. It seriously decoupled.

Some people in the industry believe that if the price difference between ferronickel and pure Nickel exceeds 200 yuan/nickel, it can be said that Nickel and stainless steel are decoupled. According to pure nickel 203080/ton, the single nickel point is estimated to be 2030 yuan/nickel. The current mainstream reference price of Nickel and iron is 1600-1700. The difference between the two is 330-430 yuan/nickel, and it has been decoupled.

Another simple algorithm can also see that stainless steel’s current nickel price is seriously decoupled. According to the nickel price of 80,000 USD/ton, USD80,000*8%=6,400USD/MT, the nickel cost for smelting a single ton of stainless steel is 38,400 yuan/ton. Of course, this algorithm is not scientific, and steel mills will not buy pure Nickel worth $80,000 to produce stainless steel. Nevertheless, this shows that the relative nickel price has been out of the scope of supply and demand, and the cost of stainless steel is still undervalued.

3. The fundamental bullish factors have been digested, and the market outlook is waiting for demand verification

Under the current decoupling between nickel price and stainless steel, stainless steel has already stood at 22000-23000 yuan/ton; if Qingshan does not hesitate to reduce the production of stainless steel through processes such as high Nickel matte, Nickel, and stainless steel must be linked. The final result may not be a drop in nickel price, but a The price of stainless steel is raised, so the era of stainless steel starting with the word 3 will not belong.

According to the current 1590 yuan/nickel high nickel-iron, 8800 yuan/50 base ton of ferrochromium, 14100 yuan/of scrap stainless steel (excluding tax) raw materials, and 22200 yuan/ton of spot price, the steel mill will make immediate 304 cold rolling profit The rate is already 9%-15%. Therefore, it can be said that the current stainless steel industry chain already has good gains. For steel mills, at this time, they can choose to buy relatively low raw materials. If the demand in the peak season is verified, they can also obtain better profits.

To sum up, the current rise of Nickel in London is fantastic; the price of stainless steel is rising too fast, and downstream merchants are more cautious about the current situation of stainless steel. As a result, most merchants of stainless steel profiles have also chosen not to quote or not to ship and wait for the market to stabilize or steel mills to open for follow-up operations.

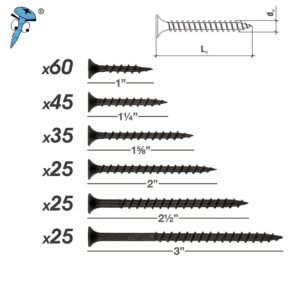

Rising raw material costs stainless steel fasteners or current price surge

The price of raw materials has risen sharply, and the trend has been rapid and continuous. In this case, most fastener companies are overwhelmed and on the verge of loss. Nevertheless, some companies can maintain operations with the same sales price because they are still digesting the stock early, including the supply of raw materials and the inventory of products. After this buffer period expires, the consequences will be conceivable.

Although the reasons for the analysis are various, and it seems logical, the final pressure must be borne by the fastener companies in the middle and downstream. In addition, due to the continuous increase in transportation and packaging accessories prices due to the constant rise of various raw materials, most fastener companies have been intimidated, and some companies can only be forced to increase fastener prices.

Aozhan Industrial issued a price increase notice and price adjustment notice on March 8. However, due to the continuous increase in the market price of raw materials, the quotations of steel mills remain high and cannot be relieved in the short term.

With this wave of raw materials soaring, Prince Fastener estimates that more fastener companies will be forced to join the price hike.